Home > Wall Street > Caveat Emptor: There’s more!

Caveat Emptor: There’s more!

This is Part 5 of a six part series on choosing a 401k plan advisor.

This is Part 5 of a six part series on choosing a 401k plan advisor.

While many nationally recognized insurance and brokerage firms advertise that they have the knowledge, resources and expertise to assist the 401k plan sponsor in fulfilling their fiduciary duties, nearly all, in the fine print, state that they, nor their advisors, act in any fiduciary capacity!

Several nationally recognized 401k service providers offer some sort of “Fiduciary Warranty” and many plan sponsors believe this gimmick protects them from fiduciary liability. However, in the fine print, one typically finds significant qualifications to this warranty. One major provider states, in the fine print, that their warranty only protects the plan sponsor from the “BroadRange” or Diversification Rule. The Broad Range Rule requires that a plan offer participants at least three investment options which have substantially different risk/reward profiles. The fine print specifically states that the warranty does not cover the quality of the investments options, nor the reasonableness of the fees of those investment options. To add to the deception, in many cases the service provider’s own proprietary, often more expensive, investment options must be used for this warranty to apply! More on this in “Caveat Emptor for 401k Plan Sponsors.”

Are you compliant with ERISA Section 411?

ERISA Section 411 provides 22 eligibility criteria. It is a violation of ERISA for anyone not compliant with these 22 criteria to act as a fiduciary on an ERISA plan. These criteria apply not just to outside or independent advisors, but also to the employees within a company who are fiduciaries.

Do you hold either the Accredited Investment Fiduciary (AIF), Accredited Investment Fiduciary Analyst (AIFA) or Global Financial Steward designations? Or the Qualified Plan Financial Consultant (QPFC) from the American Society of Pension Professionals & Actuaries (ASPPA)?

The AIF, AIFA and GFS are the few professional designations in the country focusing on one’s expertise in fiduciary issues. ASPPA offers several well respected designations, but the Qualified Plan Financial Consultant (QPFC) is the most common and appropriate for a plan advisor.

No designation guarantees that your service provider is assuming true fiduciary status, or even that they are putting your interests ahead of their own. However plan sponsors ought to be especially cautious of any title or designation created by some of the larger broker-dealers, and held exclusively by their own representatives. See Check a Credential to determine the quality of an advisor’s credential.

When it comes to titles, the most troublesome in the 401k industry are Financial Advisor and Financial Consultant. As I mentioned in Part II of this series, there are different laws governing Registered Investment Advisors and the salespeople of brokerage firms. Under the Securities Exchange Act there is no mention of advisors or consultants, only stockbrokers and registered representatives. While there is no question that I provided my client’s with advice during my 14 years in the brokerage industry as both a Financial Advisor and Financial Consultant, I later discovered that these are merely marketing terms and that what I thought was sincere advice was defined by the lawyers representing my employers as merely “incidental to the sale of a product.” In other words, caveat emptor!

To learn more about Mark Mensack, visit his sites at www.prudentchampion.com and www.fiduciaryplangovernance.com.

Other posts from Mark Mensack

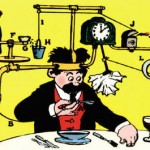

The Rube Goldberg Theory of 401k Plan Fee Disclosure

How would you feel if after buying a new car you discovered you paid too much? Odds are...

This is the final installment of a six part series on choosing a 401k plan advisor. What fees and expenses...

This is Part 4 of a six part series on choosing a 401k plan advisor? Wouldn’t a reasonable 401k...