This is the final installment of a six part series on choosing a 401k plan advisor.

This is the final installment of a six part series on choosing a 401k plan advisor.

What fees and expenses will my plan be subject to, and what compensation will you and your firm receive, if we work with you?

Insist on 100% transparency regarding all fees and expenses! Fees and expenses generally fall into three categories: Advisory, Administrative, and Investment.

Advisory fees: How does this advisor, and his employer, get paid?

Administrative or plan level fees: How does the record-keeper, administrator and custodian get paid?

Investment expense: What is the expense of the investment options, and is there any Revenue sharing that offsets either the advisory or administrative fees?

“Revenue sharing” is fiduciarily acceptable when the appropriate mutual fund share class is used and all 12b-1 fees and Sub-TA fees are accounted for and used to offset appropriate expenses.

Other fees which raise fiduciary red flags are: Administrative service charge, Sales & Service fee, Separate account expense, M&E or mortality & expense fee, base charge, asset charge, wrap fee, market value adjustment, surrender charge, and contingent deferred sales charge.

A particularly sharp advisor might address transaction costs and the value of offering “passively” rather than “actively” managed investment options. Transaction costs include commissions paid by a mutual fund for trading positions within the fund. These costs sometimes exceed the published expense ratio of the mutual fund. Passively managed funds tend to have lower transaction costs than actively managed funds.

What are all the sources of your compensation and your firm’s compensation, relative to our plan?

One caution when asking an advisor about his compensation: The advisor’s employer might have arrangements with 401k product service providers where the employer receives additional compensation above and beyond that which the advisor is aware. A plan sponsor has a fiduciary duty to discover this additional compensation which is indirectly coming from your plan assets. Unfortunately, disclosures are often buried within the prospectus and difficult to find. For more, see Rule 408(b)(2): The New Fiduciary Paradox.

Registered Representatives are generally compensated from 12b-1 fees, of which their broker-dealer keeps a percentage. While this in and of itself is not an issue, its fertile ground for conflicts of interest. Some mutual funds have no 12b-1 fees, while others have 12b-1 fees of 1%.

Most mutual funds also pay Sub-Transfer Agency (Sub-TA) fees which are supposed to offset the administration costs of a plan, and these can vary greatly by share class.

12b-1’s and Sub-TA’s are buried within the expense ratio of a mutual fund, and certain mutual funds have multiple “share classes” often identified with letters such as A, B, C, I, R, R1 through R6, all of which might have various levels of 12b-1 and Sub-TA fees.

What conflicts of interest might you, or your firm, have when providing plan level advice to sponsors, or participant level advice to employees?

Many broker-dealers receive various amounts of compensation including “other than 12b-1 & sub-TA” revenue sharing from 401k service providers, including from the individual mutual fund families offered within a 401k product. So long as all of this compensation is properly disclosed and accounted for, it’s not necessarily an issue. However many also “push” certain 401k products, or limit their product menu to providers that pay for shelf space or some other form of “pay to play” scheme. Any advisor who can offer only a limited number of 401k products, or any 401k product that limits the number of investment options from which the plan sponsor can choose is suspect.

For more on conflicts of interest, Sub-TA fees & 12b-1 fees, see “The Wizard of Oz, Retirement Plans & the SHRM Code of Ethics.” (Slides 32, 33 and 41 – 50)

To learn more about Mark Mensack, visit his sites at www.prudentchampion.com and www.fiduciaryplangovernance.com.

Other posts from Mark Mensack

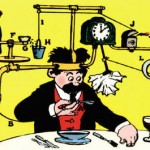

The Rube Goldberg Theory of 401k Plan Fee Disclosure

How would you feel if after buying a new car you discovered you paid too much? Odds are...

This is Part 5 of a six part series on choosing a 401k plan advisor. While many nationally recognized...

This is Part 4 of a six part series on choosing a 401k plan advisor? Wouldn’t a reasonable 401k...