Over the past decade, there has been an interesting shift in the way venture backed companies are approaching their Initial Public Offering (IPO). Historically, once a business had reached a certain valuation and earned enough public clout, the decision to ‘go public’ would be made without hesitation. This was a crowning achievement, as going public, or being acquired, was always the end goal. But, much has changed over the past couple decades.

Staying Private

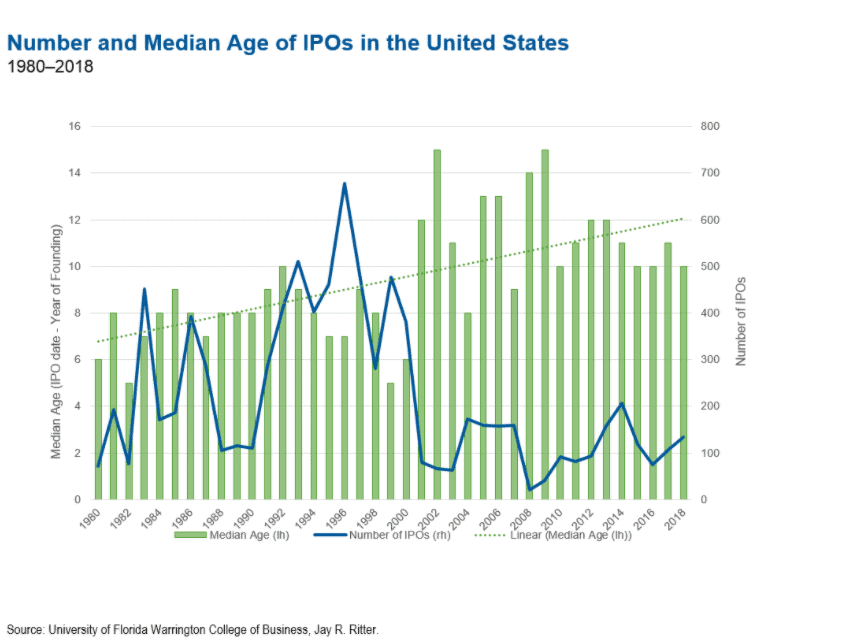

We have seen a drastic shift in the way companies are approaching going public or being acquired. Essentially, privately held companies are remaining private for longer periods of time. According to data reported by Franklin Templeton, “As of 2018, the median age of venture-capital-backed technology companies at time of IPO rose to 10.9 years, up from 7.9 years in 2006.” [i] Big name companies like Amazon (1997), Apple (1980), and Netflix (2002) all went public within 5 years of founding. [ii]

So why have companies stayed private longer? Of course, the answer must be that the move is more lucrative despite the challenges that staying private can present.

But, the proof is in the pudding, as it generally is. Let’s take a look at Amazon as just one example. Amazon became the second company to hit $1 trillion market value in September of 2018 following closely behind in Apple’s footsteps. But Amazon wasn’t always the golden goose it is today. When Amazon first went public in 1997, its stock was priced at just $18 per share with a valuation of $300 million. [iii] [iv] Could a better deal have been made had they waited longer to go public?

Fast-forward two decades to 2019 and you’ve got UBER debuting their IPO with a valuation of $82.4 BILLION and $45 a share.

And as the New York Times reports, this was “a disappointment to investors, executives and cheerleaders who had bigger dreams for it” as this was priced near the bottom range. [vi] UBER was founded and operated as a private company for 10 years before their IPO (compared to Amazon’s five).

Other popular companies that chose to ride out the private wave and postpone going public in recent years include Lyft (2019 valued at $24 billion), Pinterest (2019 valued at $10 billion), and Zoom (2019 valued at $15.9 billion) who all waited longer to go public than companies during the dot.com bubble.

Are privately held companies starting to figure out that the key to maximizing their IPO is to be in the right place at the right time? That holding out on that initial public offering could yield them a more lucrative valuation if they have more time under their belt to optimize their strategies and offerings?

The Venture Capital Window of Opportunity

As companies remain private longer, more value is being added before going public. Investors keen to this trend are now jumping on board in the later stages of the company’s private years in an attempt to capture some more of the upside potential.

However, there is a disconnect—many investors lack both an understanding of venture capital and access to this opportunistic asset class. Assuming you don’t have the time and information to research privately-held companies to invest, most individual investors will rely on a fund to gain exposure.

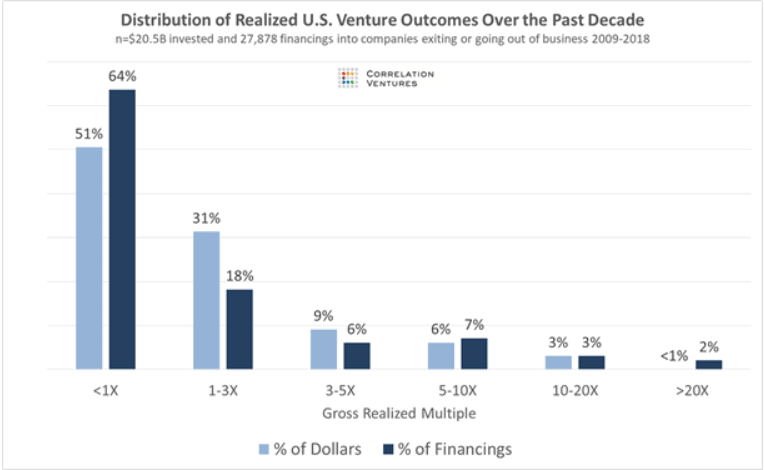

When we look at venture capital fund performance, we see a huge disparity in the top and bottom quartiles— possibly the biggest disparity of any asset class. In other words, venture capital returns are painstakingly skewed (Figure 1). So, going into venture investing blindly is far from advisable.

Figure 1

Source: Venture Capital — No, We’re Not Normal | by David Coats | VC by the Numbers | Medium [vii]

As pointed out by David Coats in his aforementioned article and as shown in the above figure:

About half (51%) of all of the capital invested into venture-funded companies exiting over the last decade lost money, while less than 4% generated a 10X or greater multiple. When calculated as a percent of financings, rather than by dollars, the distribution is even more skewed: almost two thirds of financings lost money for investors.

Investors will want to gain access to the relatively small number of managers generating the lion’s share of the returns to justify participating in this asset class.

Is Venture Capital Right for You?

To answer this question, you first need to understand a few basic facts: venture capital would typically represent a very small percent of an individual’s portfolio, requires a high-risk tolerance and substantial investment amount. Aligning with the best managers can provide for a higher chance of exceptional returns while also adding diversification for a portfolio.

Let the CERTIFIED FINANCIAL PLANNER™ professionals at Williams Asset Management help you decide if venture capital fits into your portfolio. Whether you need comprehensive and holistic financial planning or investment management, we can help! We are fee-based, independent financial advisors located in Columbia, the heart of Howard County, Maryland. Schedule your complimentary consultation today by calling 4107400220!

Brian McKinney, CFP®, is a wealth manager with Williams Asset Management. Williams Asset Management is located at 8850 Columbia 100 Parkway, Suite 204, Columbia, MD 21045. They offer advisory services as Investment Adviser Representatives of Commonwealth Financial Network®, a Registered Investment Adviser. Fixed insurance products and services offered by Williams Asset Management. For additional information about the services of Williams Asset Management, please call (410) 740-0220 or email at Info@WilliamsAsset.com. © Williams Asset Management. For more information about Williams Asset Management, please visit www.WilliamsAssetManagement.com.

References:

[i] https://global.beyondbullsandbears.com/2019/05/24/fomo-investors-fear-missing-out-as-companies-stay-private-for-

longer/#:~:text=%E2%80%9CNew%20economy%E2%80%9D%20companies% 20in%20particular,a%20large%20number%20of%20shareholders, May 24 2019

[ii]https://finance.yahoo.com/news/bad-for-investors-when-companies-like-uber-wait-too-long-to-go-public-143820861.html, May 31 2019

[iii] https://press.aboutamazon.com/news-releases/news-release-details/amazoncom-inc-announces-initial-public-offering-3000000-shares, May 14 1997

[iv] https://www.wired.com/1997/03/amazon-com-high-on-ipo-so-is-its-valuation/, 26 March 1997

[v] [vii] https://www.nytimes.com/2019/05/09/technology/uber-ipo-stock-price.html, May 9 2019

[vii ] https://medium.com/correlation-ventures/venture-capital-no-were-not-normal-32a26edea7c7, September 11 2019

Other posts from Brain McKinney

How to Have Fun With Your Investment Portfolio

As our clients are well-aware, we take a long-term view with our investment philosophy, focusing on crafting diversified...

2020: Embracing the Silver Linings

As 2020 draws to a close, it’s likely that many of us are harboring a host of mixed...

Should You Add Gold to Your Investment Portfolio?

Gold has been a valuable and highly coveted commodity for centuries. Unlike other common investment asset classes, you...