Home > Wall Street > Why Does Wall Street Fight Mandatory Disclosure for Financial Advisors?

Why Does Wall Street Fight Mandatory Disclosure for Financial Advisors?

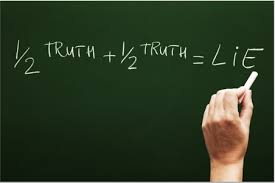

Very few financial advisors have audited track records or quality ratings by objective third parties. And, there is limited public data that documents the quality of financial advisors. Consequently, not one investor in a hundred has an effective process in place for obtaining information from financial advisors. This allows financial advisors to control what investors know and do not know about their ability to provide competent, ethical advice and services.

Very few financial advisors have audited track records or quality ratings by objective third parties. And, there is limited public data that documents the quality of financial advisors. Consequently, not one investor in a hundred has an effective process in place for obtaining information from financial advisors. This allows financial advisors to control what investors know and do not know about their ability to provide competent, ethical advice and services.

Paladin Advisor Research (www.PaladinRegistry.com) provides free tools to investors that they use to research financial advisors. Rather than develop processes themselves they rely on Paladin’s free research and rating tools to obtain and compare information for them.

There is no legitimate reason why financial advisors cannot practice full disclosure for their credentials, ethics, business practices, and services. In a recent Paladin Research survey, these are the four categories of information that investors review the most when they select financial advisors for their assets.

What organization is responsible for regulations that allow financial advisors to withhold information from investors who depend on them for expertise that helps them achieve their financial goals?

A Low Risk Alternative

Financial advisors, who volunteer complete, accurate information for their credentials and ethics, reduce investor risk of selecting low quality financial advisors with the best sales skills. Investors have the factual information they need to select the best advisors.

A High Risk Reality

However, very few financial advisors volunteer this type of information so a low risk alternative becomes a high-risk reality. Investors have to develop a process for obtaining key information from advisors, they have to ask the right questions, and they have to know good answers from bad ones.

The Wall Street Influence

Wall Street companies employ or license hundreds of thousands of financial advisors. Its companies spend hundreds of millions of dollars per year on lobbyists who make sure financial advisors do not have mandatory disclosure requirements.

What is Wall Street hiding? 75% of its financial advisors are really sales representatives who are paid commissions to sell investment and insurance products. They are not financial experts and their licensing does not permit them to provide financial advice or ongoing services.

Wall Street knows investors do not want sales reps managing their assets. Rather than upgrade the quality of its representatives, which takes time and money its alternative is to withhold information and make it your responsibility to discover the facts.

Low Quality Financial Advisors

It stands to reason low quality financial advisors have a lot to hide. They withhold information that would cause investors to reject their sales recommendations or terminate current relationships. In fact, the lower the quality of advisors, the more they depend on their sales skills to make money. One of their most effective strategies is to market themselves as financial experts even though it is not true. They get away with it because they know very few investors ask the right questions and require documented responses.

High Quality Financial Advisors

It is ironic, but high quality financial advisors tend to use the same marketing tactics as their lower quality competitors. Perhaps that is because they used to be lower quality advisors. Unfortunately, they did not change their marketing tactics as they acquired increasing amounts of financial knowledge. Consequently, they are not very good at differentiating themselves. This puts pressure on investors to know enough to determine the quality of financial advisors.

Other posts from Jack Waymire

Paladin’s Registry of Financial Advisors is a Free Service for Investors

The world’s first financial advisor directory was the Yellow Pages®. All you had to do was thumb through...

How to Find the Best Financial Advisors

Your first step is to determine the criteria you will use to identify and select the best financial...

What is an Investment Performance Benchmark?

A Benchmark is a performance goal. Your advisor is paid to produce results that beat the performance of...