Home > Retirement > New Year’s Resolution: Invest for Retirement More Responsibly

New Year’s Resolution: Invest for Retirement More Responsibly

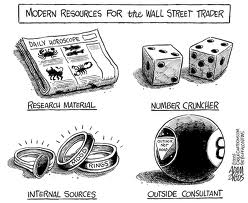

You cannot turn your assets over to a financial advisor and hope you achieve your retirement goals. You have to take more responsibility for the choices you make. Blind faith produces hidden risks that can undermine the achievement of your goals for a secure, comfortable retirement.

You cannot turn your assets over to a financial advisor and hope you achieve your retirement goals. You have to take more responsibility for the choices you make. Blind faith produces hidden risks that can undermine the achievement of your goals for a secure, comfortable retirement.

Your Responsibility

You can delegate investment work and decision-making to financial advisors. But, you cannot delegate your decision to select and retain particular advisors. These decisions are your sole responsibility.

You cannot depend on regulatory agencies (FINRA, SEC, and State) to protect your financial interests for you. They have limited enforcement capabilities and you are usually damaged before they take any action.

It is up to you to take responsibility for your financial well being when you invest for retirement.

Who Controls the Data?

You may already have a financial advisor who invests your retirement assets. Think back to the process you used to select the advisor.

- Did the advisor control all of the data you relied on to make your selection decision?

- Was all of the information verbal so you have no record of what was said to you?

- Did you select the advisor with the best personality?

- Did the advisor make undocumented sales claims that influenced your expectations for performance, risk exposure, and investment expenses?

Your answers will help you determine who controlled your decision – you or your advisor.

Not My Advisor!

You must take more responsibility for your decisions because you cannot afford to live in denial. The advisor you select and retain will impact when you retire, how you live in retirement, and your financial security late in life. What is more important than these retirement milestones?

You cannot afford to assume your advisor will always act in your best interests. He has to make a living from your assets. It is very risky to assume, no matter how much you like your current advisor, that he will not take advantage of you to make more money. This is the biggest mistake that most investors make. They are lulled into complacency by their relationships with advisors. They assume friends do not take advantage of friends.

Your New Year’s Resolution

Your resolution is not to learn how to do your advisor’s job yourself. That could take thousands of hours. But, you can resolve to take more responsibility for the selection of an advisor with the best credentials, ethics, business practices, and services. Or, if you already have an advisor, make sure you are receiving competitive results for reasonable amounts of risk and expense.

You do not have to reinvent the wheel to achieve this resolution. You can find an abundant amount of free information and services on the Paladin Registry website.

Other posts from Jack Waymire

Paladin’s Registry of Financial Advisors is a Free Service for Investors

The world’s first financial advisor directory was the Yellow Pages®. All you had to do was thumb through...

How to Find the Best Financial Advisors

Your first step is to determine the criteria you will use to identify and select the best financial...

What is an Investment Performance Benchmark?

A Benchmark is a performance goal. Your advisor is paid to produce results that beat the performance of...