Let’s start with this past week –

Let’s start with this past week –

Markets climbed higher this past week as investors were buoyed by better than expected employment figures. Stocks were led higher by Technology and Healthcare shares, while a reversal in interest rates hit utility stocks hard. Emerging markets and small cap stocks were the big winners last week, emphasizing the appetite for risk that investors have at this point. While last week was characterized by weak volume (excluding the opening of the new quarter), trading should pick up over the coming weeks as earnings reports kick into high gear.

Asset Swaps are driving Merger Activity-

Big Mergers are back. To fund them, buyers are using a little creative thinking and a lot of common stock to fuel the best quarter for global takeovers since 2007. As they agreed to more than $900 billion of purchases in the second quarter, buyers turned to their rising stock prices to finance deals. For buyers with public listings, all-cash offers made up about one-third of the takeovers announced in the second quarter, data compiled by Bloomberg show. A year earlier, all-cash bids accounted for two-thirds of deals, and in the five years through 2013 they averaged 50 percent.

Interest Rates will remain Lower Longer-

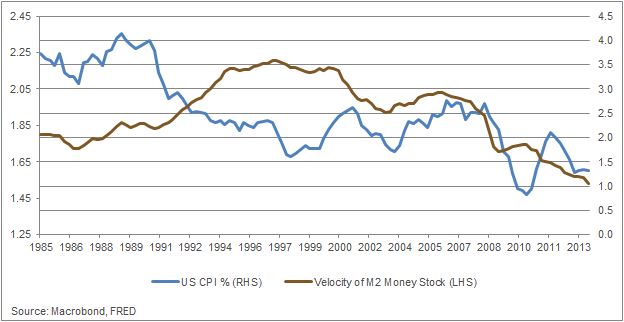

Tyler Mordy, has written “The real enemy of the bond market is inflation. Since the financial crisis, a widely held assumption is that ballooning central bank balance sheets would lead to a rapid rise in consumer prices. Evidently, that was wrong. The correct interpretation is that quantitative easing and its monetary offshoots do not necessarily guarantee credit expansion and, hence, a rise in inflation. That’s abundantly clear now. Deflationary forces have been much more persistent in recent years than inflationary ones, although “asset price inflation” has been undeniably rampant.”

The general thought that interest rates are headed higher, but the actions of the bond market over the past 6 months may suggest otherwise. If there is anything that the past 6 months has taught us, it is to always remember that when everyone is leaning in one direction there is a great possibility that the market is going to go in wherever the greatest pain for investors lies. With so many still forecasting higher rates to come, could it be possible that the market is going to continue to apply the pain trade, or will it finally reward those who have suffered the pain throughout the first half of the year.

To learn more about Guy Conger, view his Paladin Registry profile.

Other posts from Guy Conger

Market Volatility Is Nothing New

I’m tasked with writing financial articles for many internet sites and even a few publications. I find this...

Some Words of Wisdom to Investors

Dear Fellow Investor, the events of the last couple of weeks gave me the idea of providing a...

Interest Rates Rise as Fed Decides

After waiting seemingly forever, the Fed finally raised short-term interest rates last week by 25 basis points, or...