Home > Retirement > The 401k Retirement Challenge

The 401k Retirement Challenge

When the tax code was changed years ago to include the 401k, companies moved away from offering of pensions, hence letting individuals manage their own money for retirement. This was either a boon or a bust if the individual enjoyed doing this.

When the tax code was changed years ago to include the 401k, companies moved away from offering of pensions, hence letting individuals manage their own money for retirement. This was either a boon or a bust if the individual enjoyed doing this.

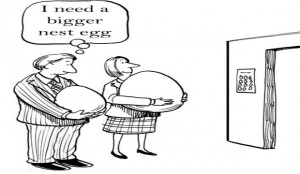

For most individuals, their 401k is a challenge.

Unlike having a pension plan, most people think about recent returns from the investments received. Unfortunately, investing does not work that way. The best performing investments in a period can easily be the worst performing investments for the next period.

After a year, like 2013, when the S&P 500 was up 29.6%, the thought of allocating money to anything but stocks is a far off thought. However, this is exactly what Ben Inker and Martin Tarlie, both from GMO, suggested in Investing for Retirement: The Defined Contribution Challenge.

The idea of building a portfolio is often not thought through. People often spend more time on purchasing a television set, than they do on their portfolio.

Thinking about one’s portfolio that may last 40, 50 or 60 years is an albatross.

Today’s high valuations and low interest rates make it particularly difficult for savers to do the right thing. The government and, more specifically, the Federal Reserve antagonize people to invest in the stock market. Nonetheless, high valuations make it inherently difficult to do so.

Individuals have always known that savings is the key to a healthy retirement. But, this is even more important today when valuations are such a head wind. As a financial planner, you may be able to increase a person’s savings rate leading in to retirement; however, it is difficult and will force the individual to completely change his lifestyle.

The return of an individual experience, now commonly referred to as the “glide path”, will have a profound impact on what an individual can ultimately spend. Inker and Tarlie’s research harkens back to Kitces and Pfau’s research on Reducing Retirement Risk with a Rising Equity Glide Path. The title suggests having greater stock exposure through retirement. The more important part is that one should start with small stock exposure and increase this later.

However, Inker and Tarlie took the suggestions further to have a Dynamic portfolio through the two phases of investing, both in accumulation and in retirement. I’ll cover this in more detail in my subsequent articles.

To learn more about James Cornehlsen, view his Paladin Registry profile.

Other posts from James Cornehlsen

More Republican Presidential Candidates than Retirement Opportunities?

The title of this article is not quite true, but close. With 15 candidates in place for the...

Automated Investment Tools – Are They Landing in Your Back Yard?

Automated investment tools, or Robo-advisors as they are commonly known, are not aliens or robots landing in your...

Can You Reach Your Financial Goals for Retirement?

I was taught by my coach, Jack Beatty, to reach one’s goals generally involves having a person to...