If you are someone who scrutinizes their account statements or your financial documents, you might have come across the word ‘FINRA’ – probably in a very small font size. Have you wondered what it stands for? How does it affect you? Why should you care?

In this article, we will answer all of these questions and help you understand everything you should know about it.

1. What is FINRA?

Simply put, FINRA stands for the Financial Industry Regulatory Authority and it’s your first line of defense against a bad experience with a securities broker. But it also does a lot more. Let us understand in detail.

You know that millions of transactions happen every day in our financial markets – stocks and mutual funds are traded, there is your 401(k) being put to work, engagement in derivatives, commodities, fixed income – and all of this happens directly, or through brokers or brokerage firms. Although the SEC – the Securities and Exchange Commission – is the all-seeing, all-powerful body responsible for creating this secure trading environment, FINRA holds an ace of spades in this mission to protect investors and regulate the securities industry.

FINRA is an independent, non-governmental organization that regulates and oversees the actions of its members – the exchange market firms, brokers, brokerages, etc. It is a self-regulatory body for brokers and dealers in the United States. It oversees all securities licensing procedures and requirements for the United States.

a. The Inception of FINRA

Experts estimate it took nearly 25 years for the markets to revive after the crash of 1929 – a dreary statistic often brought to investors’ attention for various reasons. Nonetheless, the lessons learned from it are innumerable. According to government-sponsored studies, unregulated securities markets had an upper hand in causing the crash. In an attempt to prevent such future meltdowns, certain regulatory bodies were established – the SEC and the National Association of Securities Dealers (NASD) which became the first self-regulatory organization (SRO) in the securities industry.

With technological advancement, this predominantly regulatory and administrative body expanded operations and set up a trading platform called the National Association of Securities Dealers Automated Quotations market in 1971 – what we know as the NASDAQ. It quickly gained popularity, especially among smaller companies. In 1998, NASDAQ merged with AMEX – The American Stock Exchange and later further merged with other exchanges…a story for later.

Now, NASD was not the only SRO, though it indeed did reign as the leading private authority in the securities market. Exchanges too had their own ‘corporate lobby’ – like the NYSE Regulation, Inc., of the New York Stock Exchange (NYSE). On 26 July 2007, the SEC approved the merger of NASD with NYSE Regulation, Inc. to give birth to FINRA.

2. What does FINRA do

FINRA, as a not-for-profit agency, focuses on the root of problems – securities sold to investors and ones selling them to investors. The organization oversees about 4,250 brokerage firms, 162,155 branch offices and 629,525 registered securities representatives. It proactively monitors the products and services offered by each of them to safeguard investor interests.

FINRA strives to ensure the following:

- Investors get a basic level of protection

- Anyone who sells securities products is licensed and qualified

- Securities product advertisements are not misleading

- All securities sold to investors meet at least the suitability standard of care

- Disclosure and disclaimers are accessible to investors prior to purchase of securities

FINRA’s mission is to safeguard the investing public against fraud and bad practices. It does this by setting up task forces to help it administer its responsibilities efficiently:

a. Member Regulation Department

This department is in charge of monitoring its members’ compliance with industry rules and regulations. It keeps an eye out to detect and prevent wrongdoing in the US markets. FINRA mandates that anyone selling securities products or supervising those who do, to be qualified and licensed by FINRA.

It also refers suspicious cases to the SEC and other appropriate agencies.

b. Market Regulation Department

The Market Regulation Department conducts examinations and investigations of trading activity in US equities, options, and fixed income markets. It proactively performs surveillance functions, processing up to 75 billion transactions per day.

Financial advisors need to gain membership to FINRA or register with a FINRA member-firm by passing certain qualifying examinations administered by FINRA to be eligible to deal securities to investors. Some of these examinations include the Series 7 General Securities Representative Qualification Examination and the Series 3 National Commodities Futures Examination.

c. Enforcement Department

This wing is the most powerful and also the most criticized of FINRA’s departments. It is charged with the duty of investigating potential misbehavior and taking disciplinary action when necessary. Disciplinary actions range from fines to barring advisors from practising. Remember that FINRA is backed by the SEC. A disciplinary action by FINRA is quite a black spot on the career of a financial advisor, which goes into their permanent records. Therefore, it comes across as a deterrent to wrongdoing. The department also works towards obtaining restitution for harmed investors, protecting seniors and vulnerable investors, and ensuring the integrity of the market.

d. Transparency Services Department

This department focuses on over-the-counter securities and trading by maintaining databases and disseminating real-time and historical market information. This also goes towards facilitating timely information to investors to make an informed choice before investing in products recommended by brokers or advisory firms, as well as recording executed trades.

Starting in 2020, FINRA has begun a multi-year initiative dedicated to improving trade reporting and reference data management capabilities for member firms. FINRA has employed a number of reporting tools and systems to help the member firms comply with reporting requirements and facilitate transparency in the market.

e. Registration and Disclosure Department

The Registration and Disclosure department, often referred to as RAD, deals with registering and testing securities industry personnel. It is mandatory for firms and individuals to register with FINRA – including salespersons, branch managers, department supervisors, partners, officers and directors – basically any person engaged in the securities business – before they can take a qualification exam. This compiled database of registered advisors and securities dealers, their certifications and disclosures are freely available on the FINRA website for investor’s consumption.

f. Dispute Resolution Department

It is a rare occurrence that an investor finds himself in dispute with his broker or broking firm that escalates to the point that authorities need to be involved. However, in case it does, you may be rest assured that FINRA will serve as a mediator to facilitate a fair and just process to arrive at an amicable resolution, without escalation to the courts. FINRA runs the largest forum specifically designed to resolve securities-related disputes between investors, securities firms and individual brokers, arbitrating and mediating conflicts. This falls under the jurisdiction of the Dispute Resolution department of FINRA.

3. Tools FINRA Provides for Investor Protection

Here are the resources FINRA provides for investors to be confident about participating in financial markets:

a. BrokerCheck

This is a free tool to research background information and experience of brokers, advisers and firms. It helps check and verify certifications, regulatory actions if any, and investment-related licensing information, arbitration and complaints.

Paladin Registry highly recommends you to verify employment history and arbitration details of your chosen financial advisor on BrokerCheck. Paladin Registry continuously strives to match you with pre-screened financial fiduciaries and validates and documents advisor qualifications and business practices.

b. Dispute Resolution Forum

FINRA sponsors and administers the largest securities dispute resolution forum in the United States. The platform is unbiased, and though FINRA staff coordinate the dispute resolution process, they are not involved in rendering judgement. FINRA provides Mediation and Arbitration services to the disgruntled and serves as the first avenue before the SEC or the courts get involved. Do you have a complaint to raise?

c. Securities Helpline for Seniors

FINRA runs a toll-free call-in service for senior investors to get assistance or raise concerns about brokers or investment products.

d. Whistleblower Facility

Given FINRA’s goals to achieve a clean marketplace for securities trading and bring wrongdoers to justice, it encourages individuals with information about potentially fraudulent, illegal or unethical activity to contact the Whistleblower Tip Line at 1-866-963-4672. Individuals outside the US can call at (646) 315-7293. Email FINRA: whistleblower (at) finra (dot) org

e. Investor Complaint Centre

The Complaint Center provides a forum for customers and securities personnel to alert FINRA of suspicious activities or behavior instantly. If your securities advisor has mistreated you, and the advisor/firm is not willing to address your concerns, FINRA can be notified. FINRA is empowered to investigate and take disciplinary action against brokers and their firms.

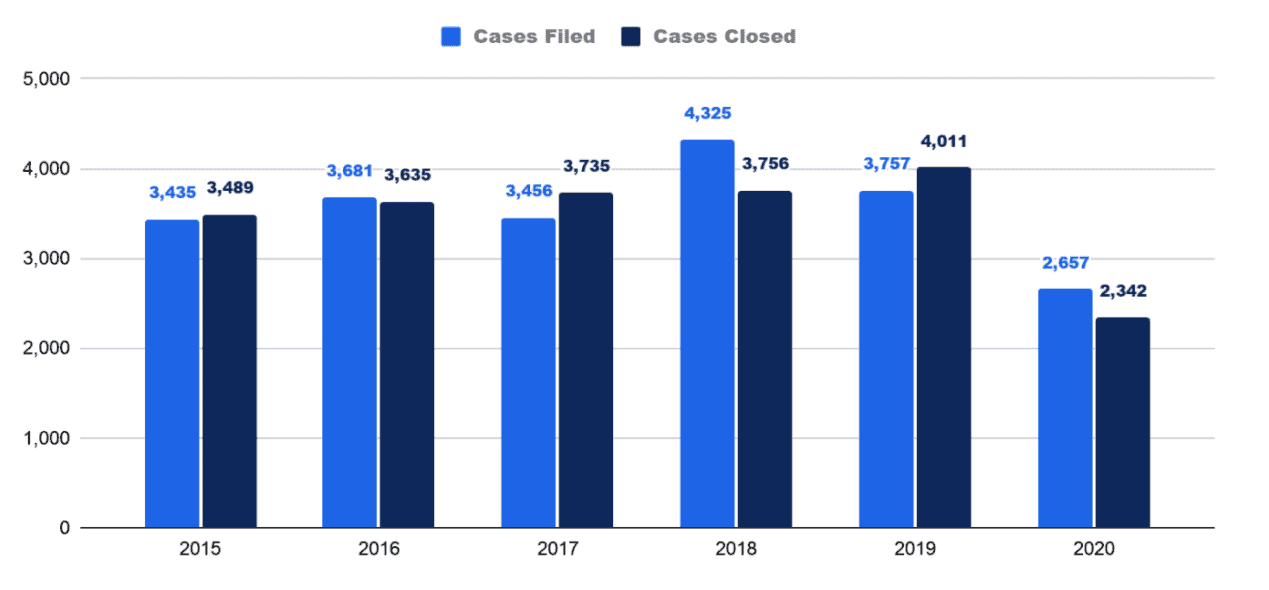

4. Cases Filed & Closed by FINRA (2019)

a. Historical Statistics for Cases Filed and Closed

b. Leadership at FINRA:

FINRA is headed by a board of governors comprising of:

- CEO of FINRA

- 12 Governors of the public

- 10 Governors of the securities industry

The 10 Governors include:

- 3 Governors for large-sized firms

- 3 Governors for small-sized firms

- 1 Governor for mid-sized firms

- 1 Floor Member Governor

- 1 Governor of independent dealer/insurance affiliates

- 1 Investment Company Affiliate

The members of FINRA elect the Governors of firms according to their size classification.

Currently, the board of governors includes people working for Kovack Securities, Lantern Investments, Fidelity Investing, Brookings Institution, Georgetown University Law Centre, Cambridge Investment Research, and FINRA CEO Robert W. Cook.

c. FINRA Gets as Much Criticism as any Self-Regulatory Organization

What you Should Take into Consideration:

Even though FINRA is government- authorized, it is ultimately a private firm with powers to write its own rules but govern over other security market players, is a bitter pill to swallow for some.

While FINRA is striving its best to create an environment of trust, there is, nevertheless, certain displeasure in the way FINRA conducts itself, given that there is limited information on accountability, funding, how it spends money collected as fees and fines, how it sets its regulatory agenda, how it writes its own rules, and how it releases information. (Note that as per law, neither can the public attend its meetings nor is FINRA subject to the Freedom of Information Act which allows anyone to request information from a federal agency).

This government-authorized private firm wields power over the lives of brokers and broker-dealers. As an SRO, FINRA is protected with absolute immunity against lawsuits by its own members. Experts feel that the firm is largely unaccountable to the industry or to the public.

FINRA also seems to be under duress from the investor community. It has been noted that advisors or firms suspended or banned from operations are back in the market within a short time span. If you look at our section on Cases Filed & Closed by FINRA, you might notice that these numbers have been constantly declining over the past few years. It has been worrisome to few that the close nexus with industry professionals is perhaps influencing the enforcement arm of FINRA.

Nonetheless, we cannot discount the fact that FINRA still provides valuable services and guidance to investors and securities professionals alike.

If you have any questions about how to evaluate an advisor’s track record, visit Dash Investments or email me at dash@dashinvestments.com.

About Dash Investments

Dash Investments is privately owned by Jonathan Dash and is an independent investment advisory firm, managing private client accounts for individuals and families across America. As a Registered Investment Advisor (RIA) firm with the SEC, they are fiduciaries who put clients’ interests ahead of everything else.

Dash Investments offers a full range of investment advisory and financial services, which are tailored to each client’s unique needs providing institutional-caliber money management services that are based upon a solid, proven research approach. In addition, each client receives comprehensive financial planning to ensure they are moving toward their financial goals.

CEO & Chief Investment Officer Jonathan Dash has been profiled by The Wall Street Journal, Barron’s, and CNBC as a leader in the investment industry with a track record of creating value for his firm’s clients.

Other posts from Jonathan Dash

Things You Should Know About RMDs if You Are Turning 73

Retirement accounts like the 401(k) and the Individual Retirement Account (IRA) are broadly classified as traditional, and Roth based on their taxability....

Should You Keep Your Money with Your Employer’s 401(k) Plan After You Retire?

One critical financial decision looms large as you approach retirement - how does a 401(k) work when you retire?...

6 Reasons Your Retirement Plan Might Change and How to Prepare For it

Planning for retirement is an essential part of securing a financially stable future. It can help you live...