Home > Retirement > Financial Goals and Milestones to Hit Before you Turn 50

Financial Goals and Milestones to Hit Before you Turn 50

Reaching the Golden Jubilee Year is a special moment in one’s life. While celebrations are in order, it is also time to reflect on and reassess your financial goals. By the time you enter your 50s, you should ideally have a plan set in place for a majority of your financial matters. This includes planning your retirement funds, investments, and savings, paying off your loans and mortgages, and taking stock of your liquid assets, etc.

Since it is likely that you will retire soon, it is also important to get more specific about what you want your retirement to look like. You may want to look back upon your investments and evaluate where you stand. Specifically, as you near retirement, it is recommended that you make alterations to your financial plans, such as reducing your investments in risky assets and focusing more on saving for costs such as healthcare. Consider speaking to a financial advisor who can help you in tailoring your financial goals to fit your evolving needs.

This article streamlines common financial goals and milestones to achieve in your 50s, so you may be better prepared to enjoy a comfortable and relaxing retirement when the time comes.

Table of Contents

4 Financial Goals to Achieve Before you Hit Your 50s

1. Becoming Debt-free

Debt consumes a lot of your financial and emotional space. To lead a relaxed and hassle-free life and to be able to enjoy a peaceful retirement, the first step you need to take is to try to clear your debts. To do this, you might have to alter or change your vision of the lifestyle you hoped to have in your earning years. You may need to rethink your buying choices; make sure that you reevaluate decisions such as buying a bigger house or car if you know it will have a significant impact on your savings. While it is natural to want to splurge in your youth, it is always wise to have a prudent approach to spending. As you age, you may want to further tighten your purse and budget your expenses to fit your earnings.

It is also advisable to visualize your retirement in order to better prepare yourself for retirement. Sit down with the details of your financial status and map out a strategy. You might even consult a financial advisor, in which case your workload is considerably reduced. Eliminating debt is not easy. You have to work hard to close your loans, be it credit card balances or bank/corporate loans, because these can eat into your savings pretty quickly.

Your kids, if you have any, are most likely to have moved out when you are in your 50s. Make the most of this time to write off your debts. One easy way is to follow the 28-36 rule:

The 28-36 percentage rule for paying off your debts:

A rule of thumb quite popular suggests that a maximum of 28% of your pre-tax income should go towards paying for home debts.

No more than 36% of your pre-tax income should go towards paying off all debt which would include your home debt, credit card bills, auto loans, personal loans, educational loans, etc.

2. Taking Control of Your Spending

In most cases, when your savings don’t seem to add up, it is a result of excessive spending. To take control of your finances in your 50s, you have to study your spending habits – how much are you spending per day, week, month, and year, and what are you spending on? Even decisions such as buying groceries and home supplies can be budgeted to reduce costs, without negatively impacting the quality of your life.

Budgeting is a good starting point to help you understand your major expenses and to reveal potential expenses to cut back on. If you find it difficult to do it all by yourself, do not hesitate to use the help of a financial advisor. Remember that controlling your spending today gives you the chance to save for the future.

3. Getting an Early Start on Saving and Investing

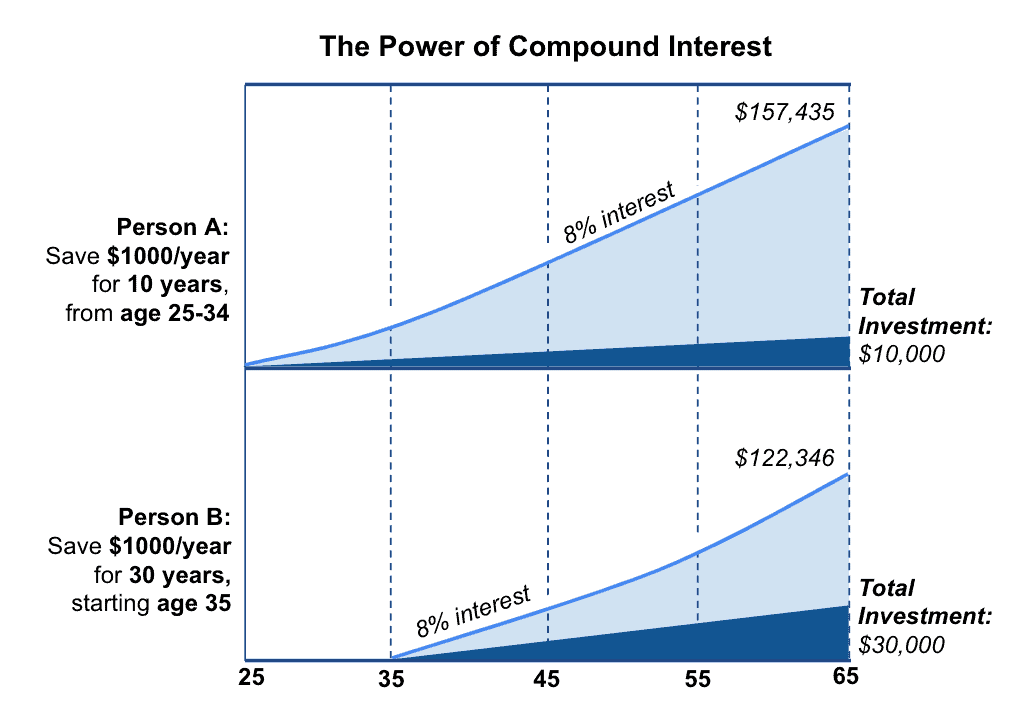

The earlier you start reviewing your finances, the more beneficial it is, as it gives you more time to save more. Even if you haven’t been big on savings in the past, it is never too late to start saving or investing. Saving early allows you to benefit from the power of compound interest. Below is an illustration to show you how compounding can benefit you:

Simply put, compounding is interest on interest. The compounding effect keeps adding to your dollars and earning interest on it, putting your own money to work for you with time. At the end of your investment horizon, you will have significant funds as a corpus. Building a safety net early on is liberating. If you do have unforeseen expenditures, you have savings to fall back upon. Hence, compounding gives you a chance to reach your financial goals faster.

4. Making Disciplined and Steady Contributions to your Savings

A financial advisor can guide you in budgeting and planning your savings and investments to make the retirement you dream of a reality. It is also advised to set up SMART goals before you start saving or investing; SMART is short for Simple, Measurable, Attainable, Realistic, and Time-bound. Treat this sum as your final goal, and set aside money each month to contribute towards this goal. For example, if you’re currently contributing 15% of your income, increase it to 17%. Six months down the line, try and bump this up to 18%. Once you automate the deduction and save money as soon as you get your paycheck, you’ll have a solid fund for emergencies.

7 Milestones to Reach Before you Turn 50

1. Have Your Catch-up Contributions in Place for your Retirement Accounts

A catch-up contribution is a type of retirement savings contribution which permits people 50 years and above to make additional contributions to their 401(k) accounts and individual retirement accounts (IRAs). It is recommended that you take advantage of catch-up contributions. If you’re 50 years or above, you can contribute up to $25,000 to your 401(k) each year. In addition to this, you can contribute an extra $1,000 to your IRA each year. This extra contribution is a good opportunity to catch up on your retirement funds. You can also maintain a growth-oriented portfolio without taking too much risk, and add your catch-up contribution value to this mix. Remember, while this is the time to increase the momentum when it comes to savings, it is advised to not take on additional risk in your portfolio.

2. Create a Long-Term Retirement Plan That Includes Healthcare Benefits

According to recent studies, more than half of all 65-year old Americans will need long-term care at some point in their lives. Hence, by the time you reach your 50s, you must start looking at options that provide you with healthcare benefits. Everybody’s needs differ, but entering retirement generally requires more provisions in place to take care of one’s health. Some might even need skilled medical assistance. Meeting the rising healthcare costs during retirement requires long-term planning, and hence, long-term insurance may prove to be a useful tool. Some points to think about while planning to meet rising healthcare costs are:

- If your employer offers a

health savings account (HSA) option, you should sign up because it would prove

to be beneficial to lay a foundation for future expenses. This money can grow

over the years. The maximum yearly HSA contribution for an individual is

$3,500, which can extend to $4,000 for people over the

age of 55. - Explore your long-term insurance options. Standard health

insurance will not provide sufficient cover for needs such as daily home assistance, and these expenses are to be kept

in mind when you’re planning for your retirement. The price of premiums

increases as you age, which means it is more costly to purchase insurance at a

later stage in life than earlier.

3. Set up a Will or a Trust

A will is not a necessity. But if you don’t have a will, a probate court will have the authority to decide on what is to be done with your assets. If you want to have full control over your finances, properties, and assets, it is advised to get a legal will made. It is also recommended that your spouse has a different will.

If you possess high net worth assets and properties, or any such assets which might mature to give beneficial value, you should consider setting up a formal estate plan. This will involve creating a trust that will protect your assets and result in fair and adequate distribution of those assets amongst your family upon your death.

A will conveys your wishes, requests, and decisions after you’re gone. You can use this voice to say what you want for your family. With proper planning, your will can ensure that properties that have monetary or sentimental value are taken care of too.

SPONSORED WISERADVISOR

Choosing the right financial advisor is daunting, especially when there are thousands of financial advisors near you. We make it easy by matching you to vetted advisors that meet your unique needs. Matched advisors are all registered with FINRA/SEC. Click to compare vetted advisors now.

4. Buy Long-term and Comprehensive Life and Health Insurance

We’ve discussed the importance of purchasing a comprehensive plan to suit the needs of a retiree. By the time you will retire, your medical and health care expenses will be quite high. To make sure that your dependents are adequately looked after, you’ll have to look for a policy with higher coverage. A life policy will provide you and your family the much-needed protection. A health policy will look after your medical expenses. Getting insurance cover earlier will comparatively cost you less because the insurance premium is linked to your age and health.

You have to purchase insurance to fit your needs. Enlisting an expert to guide you will be helpful. Sitting down and reviewing your situation, needs, goals, and costs with a financial advisor will also help you in buying the right kind and right amount of insurance that works for you and your family.

If you have already purchased insurance, take time out to review it and adjust it accordingly.

5. Set up a Portfolio with the Lowest Cost of Investment

Another aspect to take care of is the fees you’ll be paying to manage your retirement savings. If you have retirement funds and you’re paying maintenance charges, calculate how much will go towards paying fees. The figure in itself might not seem a lot. However, when you add them over the years, and you will get a substantial amount.

Many people looking to invest innovatively or in popular products such as equity mutual funds end up losing lots of dollars as fees or as a cost of investment that they could have instead contributed towards their retirement. You can minimize this expense by carefully picking out the lowest-cost funds with good long-term audited track records that suit your individual risk profile to constitute your portfolio.

6. Take Care of Your Mortgages

Debts can throw your plans out of balance. Entering retirement with a mortgage is a situation most would like to avoid, but many are subject to it. Mortgages and debt can quickly erode all your savings. So, it is prudent to try your level best to go into retirement mortgage-free. It is difficult to climb out of the debt that may have accumulated over the years. But, if you have the will and are focused on clearing payments, then a plan can be devised to pull it off.

When you are nearing your retirement, an important rule is to not take on new debt, no matter how attractive it looks. It helps to think beyond the idea of owning worldly possessions. You need to build the perspective that not having to pay towards mortgages means extra cash flow. The extra cash can be utilized elsewhere and can be a great addition to your retirement funds. The sooner you can pay off your mortgage, the closer you will get to your other financial milestones.

7. Prepare and Plan for your Retirement

By the time you’re in your 50s, you will probably have to downsize your lifestyle to make way for your retirement and the life after it. Not everybody can be Richard Branson and continue to host parties despite their age. You may need to tone down the splurging and also change your approach to investment to safeguard yourself against risks in your post-prime years.

You may start by considering your home. Is it going to be too big once the kids move out? Will you have to put in a lot of maintenance work? Do you need to host a party for your anniversary, or can you enjoy dinner at home for two? These might sound trivial at first, but are, in reality, decisions that will have an impact on your finances.

It would be best if you focused on the macro picture, continuing to be financially strong and independent after retirement, especially at a time when you cease to have regular income in the form of a salary.

The Last Word

The 50s is a good time to accelerate your retirement plans, and if you haven’t given retirement a thought, it is advised that you do so as soon as possible.

It is advised to get professional guidance in planning for your retirement. Consider reaching out to a financial advisor. Often, doing it yourself (DIY) doesn’t work out, and there is no time or resource to waste if you are already in your 50s and thinking about investment options. Ideally, your portfolio should’ve been automated, with significant savings already made and ready to review. If you do have such a portfolio, you are better prepared to get the retirement you desire. Asking around and looking for guidance can help you in achieving realistic retirement financial goals within your investment time horizon.

Begin planning, work out the details, calculate your net income, net savings, and net investments, review your insurance, and try to take a well-rounded approach to manage your finances in the coming years. Retirement marks a major change in your life, and for a smooth transition, you will have to make changes – financially, emotionally, and mentally.

If you prepare for your retirement in advance, it will be easier for you to fulfill your financial goals. Keep in mind that there will no longer be any monthly cheques, increments, or bonuses to fall back on once you decide to retire. The wisest thing to do is to have your own back by supporting yourself and planning well in advance.

Use Paladin Registry’s free match service and get matched with 1-3 financial fiduciaries that are suited to your financial goals and requirements. You may check and verify their background information on our website, and can set up a free initial consultation with your matched advisors before you make your decision to hire one.

To learn more about the most suitable tax-saving strategies for your specific financial requirements, visit Dash Investments or email me directly at dash@dashinvestments.com.

About Dash Investments

Dash Investments is privately owned by Jonathan Dash and is an independent investment advisory firm, managing private client accounts for individuals and families across America. As a Registered Investment Advisor (RIA) firm with the SEC, they are fiduciaries who put clients’ interests ahead of everything else.

Dash Investments offers a full range of investment advisory and financial services, which are tailored to each client’s unique needs providing institutional-caliber money management services that are based upon a solid, proven research approach. Additionally, each client receives comprehensive financial planning to ensure they are moving toward their financial goals. CEO & Chief Investment Officer Jonathan Dash has been covered in major business publications such as Barron’s, The Wall Street Journal, and The New York Times as a leader in the investment industry with a track record of creating value for his firm’s clients.

Other posts from Jonathan Dash

Here’s Why Every Tax Season is a Good Time to Revisit Your Financial Investments

The tax season is the perfect time to take a closer look at your financial investments. The 2025...

3 Key Financial Habits That Set Wealthy Retirees Apart

The wealthy may seem to have it all figured out, but their success is the result of years...

Things You Should Know About RMDs if You Are Turning 73

Retirement accounts like the 401(k) and the Individual Retirement Account (IRA) are broadly classified as traditional, and Roth based on their taxability....