Home > Personal Finance > 5 Financial Adages that Held True During the Pandemic

5 Financial Adages that Held True During the Pandemic

Uncertainty, unprecedented times, and volatility are three words we continue to hear throughout this coronavirus pandemic. We have also witnessed one of the biggest dichotomies between “Wall Street” (the stock market) and “Main Street” (America’s independent small businesses). While this financial upheaval and stress has certainly motivated people to search for “Covid tips and tricks” for their finances, let this article remind you how some of the most basic and oldest personal finance adages allowed prepared individuals to capitalize.

Table of Contents

1. Keep Emergency Savings

How many financial blogs or books have repeatedly urged us to keep 3-6 months of emergency money as reserves? During the pandemic, people who had cash reserves were able to play offense rather than defense. Rather than depending on stimulus checks, or PPP loans, people hit by unfortunate job layoffs or slowdowns in their businesses were able to make proactive decisions rather than reactive. Retirees were able to hold off on selling their portfolio during tough times to live, and young people were able to invest more money to take advantage of the stock market pullback.

2. Have a Savings Plan and Spend Less than you Earn

No matter how much or how little you earn, you will never get ahead if you spend more than you bring in. This sounds simple, but with online shopping, promotional credit cards and basic psychology of our wants it is easy to fall out of line. During this coronavirus pandemic, saving should have been easier than ever because most travel destinations and dining rooms had restrictions. By paying yourself first, as we have heard in many publications, chances are you had a healthy savings account and cash balance to make decisions once again from a strength point. While there were many relief programs, the flexibility of having this cash and a consistent savings goal allowed people with student loan debt or credit card debt to quickly pay down their balances without interest accrual.

3. Compound Interest is the Eighth Wonder of the World

People who had systematic investment plans or continued to dollar cost average were fortunate to take advantage of market hiccups to accumulate more shares of stock. According to Hartford funds, 42% of the S&P 500 Index Performance came from dividend income from 1930-20191. If emergency reserves were in place, and spending was less than income, people benefited from the ability to allow their investment contributions and dividend reinvestment to work its magic.

4. Stay the Course

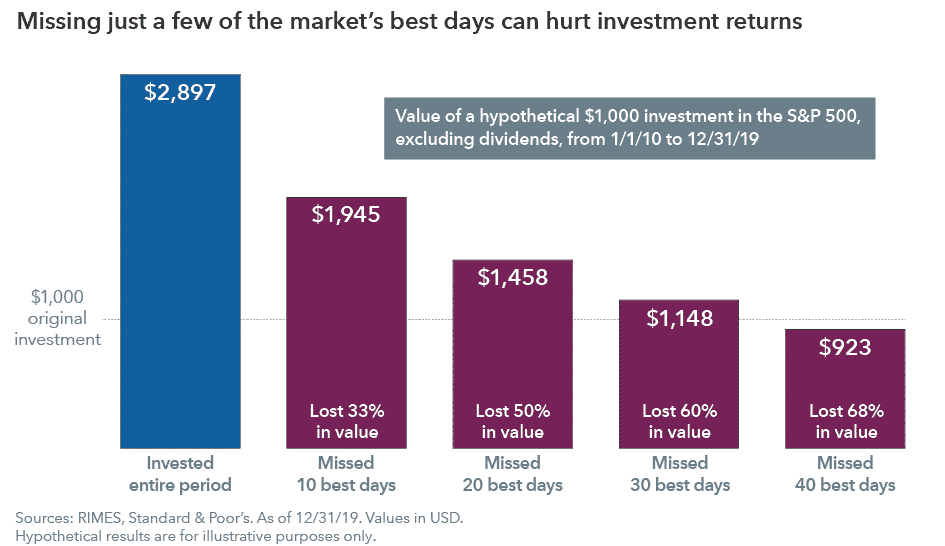

You always hear that it isn’t about “timing” the market but more about “time IN” the market. Most people think that if they go to cash or dodge market volatility, that they are saving money if they potentially buy stocks lower. However, just in the last decade, if you missed the 10 best days you would have 33% less value in your account. Based on the chart below, there are big opportunity costs to missing market gains by attempting to time the market. Once again, during the pandemic, although the market had steep and fast declines, it quickly rebounded and those who “stayed the course”, as usual, were rewarded dearly.

5. “Be fearful when others are greedy. Be greedy when others are fearful.” – Warren Buffet

A quote from a very well-known American investor and business tycoon, Warren Buffet, sums it up best. Investors who kept cash reserves and spent less than their earnings were able to be buy stocks while everyone was scared. After 100 years of stock market history, if you purchase stocks while everyone is scared, in fact during peak fear, rewards were imminent.

The key takeaway is that history has a way of repeating itself. Although, “this time WAS different”, it was the same result. Those who were prepared, came out ahead while those who were not, unfortunately were in distress. You do not need to look to deep to prepare for the next expected event that causes the market to decline, just get the basics right and ignore all the noise.

Athanassios Panagiotakopoulos is an Investment Advisor Representative with Dynamic Wealth Advisors dba LifeManaged. All investment advisory services are offered through Dynamic Wealth Advisors. He holds the Behavioral Financial Advisor, Master of Science in Finance certifications, serves as a Fiduciary to his clients and has over 12 years of experience.

1-https://www.hartfordfunds.com/market-perspectives/the-power-of-dividends.html

Other posts from Thanasi Panagiotakopoulos

How to Get the Best Financial Advice You Deserve From an Advisor

What is your financial advisor’s most valuable asset? It’s not just investments, taxes, financial plans and saving strategies. ...