Home > Personal Finance > How to Utilize the Investment Return Calculator for Financial Planning

How to Utilize the Investment Return Calculator for Financial Planning

Financial planning can be tricky, especially when you are unsure about the future potential of your investments. Market conditions, inflation, and taxes can all impact your profits, which makes it difficult to predict the outcome. However, an investment return calculator can be helpful. The calculator helps estimate potential returns from your investments while factoring in variables like inflation and taxes. It gives you a clearer picture of what to expect so you can make informed choices.

This article explores Wiser Advisor’s Investment Return Calculator, how it works, and how it can help you make better financial planning decisions.

Table of Contents

Understanding the key components of the investment return calculator

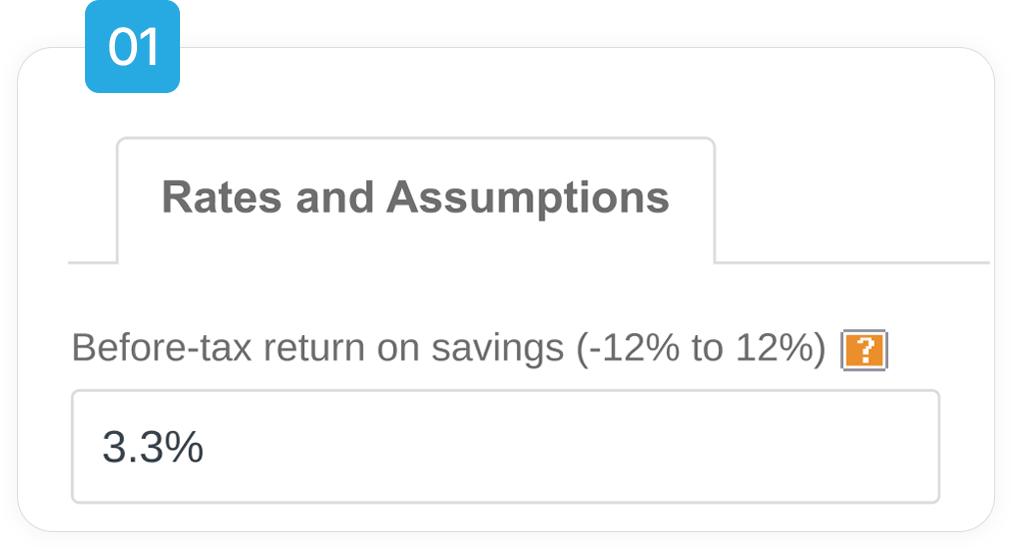

1. Before-tax return on savings (-12 to 12%)

The return on your investments before taxes determines how much growth you can expect over time. Different asset classes provide varying levels of returns. For example, historically, large U.S. company stocks have delivered an average return of 10.3%, while smaller U.S. company stocks have yielded slightly higher returns at 11.8%. A negative percentage indicates a potential loss, which is possible during market downturns. You can enter the estimated return from the asset class you are investing in, ranging between -12% and 12%.

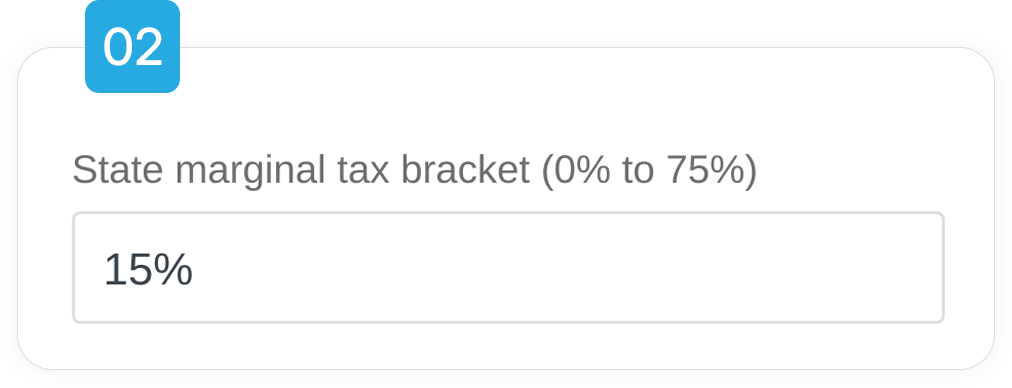

2. State marginal tax bracket (0% to 75%)

State income taxes refer to the tax levied at the state level. These taxes can vary from state to state. For example, 42 states levy income taxes, though the rates and structures differ widely. Among them, 27 states and the District of Columbia use a graduated-rate system, where higher earnings are taxed at higher percentages. On the other hand, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming do not impose any state income tax. You can select a state tax rate from 0% to 75%, depending on where you reside.

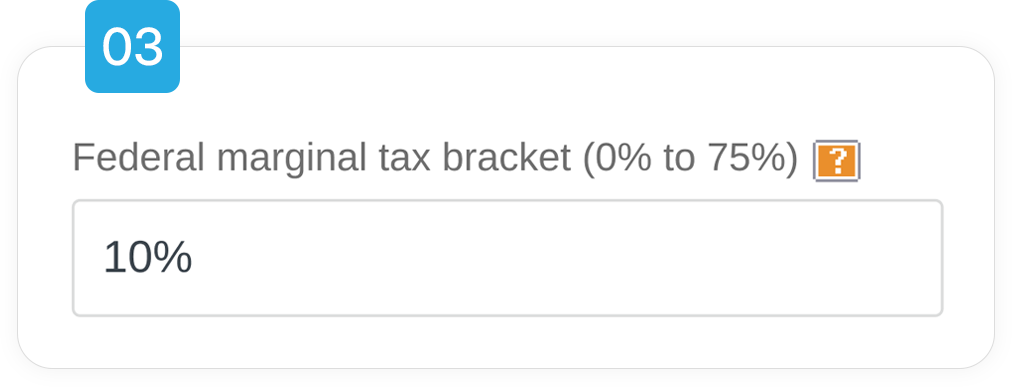

3. Federal marginal tax bracket (0% to 75%)

The federal marginal tax bracket refers to the percentage of tax applied to the last dollar of your taxable income. The Internal Revenue Service (IRS) adjusts these brackets annually to account for inflation. Understanding your tax bracket can help you understand and estimate how much of the investment return will be lost to taxes.

For 2024, the federal tax brackets are as follows:

| Tax rate | Single filers | Married filers filing jointly | Head of household filers | Married filers filing separately |

| 10% | $0 – $11,600 | $0 – $23,200 | $0 – $16,550 | $0 – $11,600 |

| 12% | $11,601 – $47,150 | $23,201 – $94,300 | $16,551 – $63,100 | $11,601 – $47,150 |

| 22% | $47,151 – $100,525 | $94,301 – $201,050 | $63,101 – $100,500 | $47,151 – $100,525 |

| 24% | $100,526 – $191,950 | $201,051 – $383,900 | $100,501 – $191,950 | $100,526 – $191,950 |

| 32% | $191,951 – $243,725 | $383,901 – $487,450 | $191,951 – $243,700 | $191,951 – $243,725 |

| 35% | $243,726 – $609,350 | $487,451 – $731,200 | $243,701 – $609,350 | $243,726 – $365,600 |

| 37% | $609,351 or higher | $731,201 or higher | $609,351 or higher | $365,601 or higher |

For 2025, the federal tax brackets are as follows:

| Tax rate | Single filers | Married filers filing jointly | Head of household filers | Married filers filing separately |

| 10% | $0 – $11,925 | $0 – $23,850 | $0 – $17,000 | $0 – $11,925 |

| 12% | $11,926 – $48,475 | $23,851 – $96,950 | $17,001 – $64,850 | $11,926 – $48,475 |

| 22% | $48,476 – $103,350 | $96,951 – $206,700 | $64,851 – $103,350 | $48,476 – $103,350 |

| 24% | $103,351 – $197,300 | $206,701 – $394,600 | $103,351 – $197,300 | $103,351 – $197,300 |

| 32% | $197,301 – $250,525 | $394,601 – $501,050 | $197,301 – $250,500 | $197,301 – $250,525 |

| 35% | $250,526 – $626,350 | $501,051 – $751,600 | $250,501 – $626,350 | $250,526 – $375,800 |

| 37% | $626,351 or higher | $751,601 or higher | $626,351 or higher | $375,801 or higher |

4. Itemize deductions

Itemize deductions can help lower your taxable income and reduce the overall tax liability. As per prevailing tax laws, you can either take the standard deduction or itemize specific expenses, such as mortgage interest, medical costs, and state and local taxes. Itemizing deductions translates to a reduced tax bill and maximizes your investment returns.

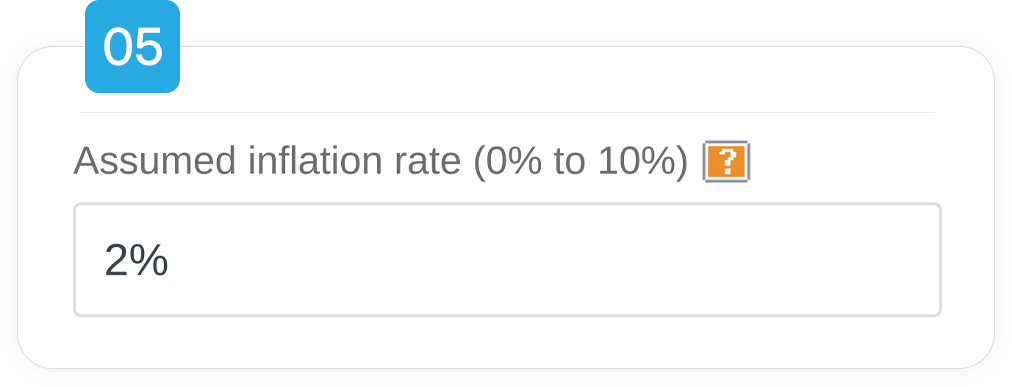

5. Assumed inflation rate (0% to 10%)

Inflation affects your investment returns, which makes it a crucial factor in financial planning. For example, if an investment grows at 10% annually but inflation is 3%, the real return is only 7%. It is important to factor in inflation to get a realistic estimate of your future returns. The inflation rate generally ranges between 0% and 10%.

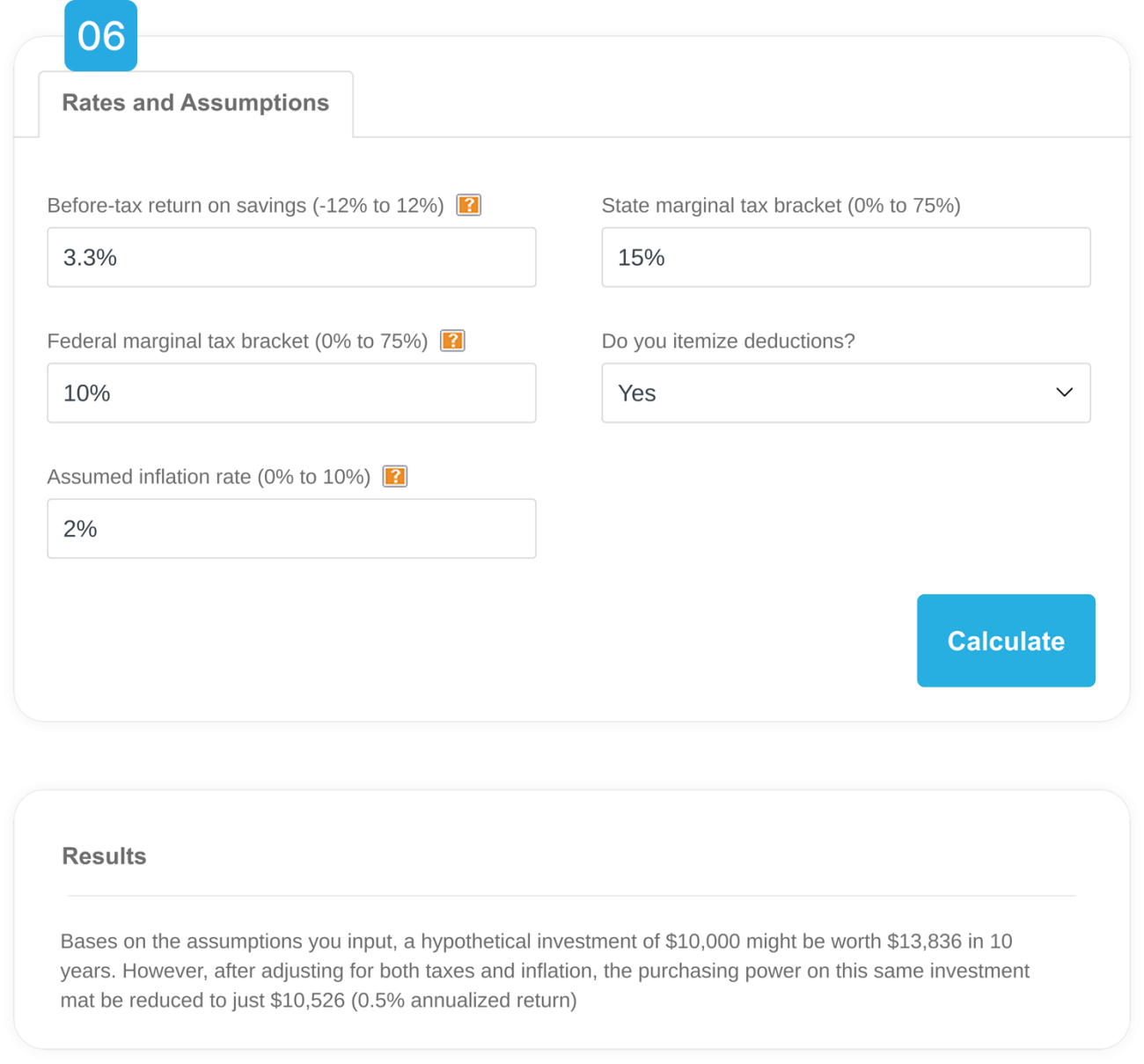

How does the investment return calculator work?

Here are the steps that you can follow to use the investment calculator for financial planning:

Step 1: Enter your expected before-tax return (-12% to 12%)

The calculator first needs your estimated annual return before taxes. This is based on the type of investments you hold. For example, if you invest in U.S Treasury Bills that have generated an average return of 3.3% in the past, you can enter this figure here. If you expect a loss due to a market downturn, you can also enter a negative return, such as -3.3%.

Step 2: Input your state tax rate (0% to 75%)

State taxes vary based on where you live. If your state does not have an income tax, you enter 0%. Otherwise, you should check your state’s tax brackets and enter a suitable value.

Step 3: Determine your federal tax bracket (0% to 75%)

Your federal marginal tax bracket depends on your income level and filing status. You need to enter the tax rate so the calculator can estimate the impact of taxes on your investment returns. For example, if you are a single filer with an income falling in the $0 to $11,600 bracket, you will fall into the 10% federal tax bracket. It is important to check the latest IRS tax brackets to ensure accuracy.

SPONSORED WISERADVISOR

Choosing the right financial advisor is daunting, especially when there are thousands of financial advisors near you. We make it easy by matching you to vetted advisors that meet your unique needs. Matched advisors are all registered with FINRA/SEC. Click to compare vetted advisors now.

Step 4: Include your itemized deductions (if applicable)

If you decide to itemize deductions in a financial year, you need to enter the total value of all qualified deductible expenses. For example, if you pay mortgage interest of $8,000 during the year, you can select ‘Yes’ here. If not, select ‘No.’

Step 5: Adjust for inflation (0% to 10%)

The calculator lets you enter an assumed inflation rate to see how your investment returns hold up over time. For example, if the inflation rate for the year is 2%, you can enter this figure. When accounting for future returns, you can also enter an inflated value since inflation is expected to rise in the future.

Step 6: Review your results

Once you have entered all the data, you can click on calculate. The calculator will estimate your after-tax investment returns. You can re-enter the expected return rate and review different scenarios if you wish. This can be helpful if you are comparing the expected returns from two or more different asset classes. You can also adjust the tax rates or inflation to see how different factors impact your long-term gains.

Importance of using the investment return calculator

The investment return calculator is a helpful tool that allows you to estimate future returns from different investments. It offers several advantages and plays a crucial role in financial planning in the following ways:

1. It helps you set realistic financial goals

The calculator helps you set pragmatic financial goals by providing you with an estimate of future returns. It can be difficult to determine how much to invest or what returns to expect from an asset. The calculator breaks it down to you so you can make informed choices. For example, if your goal is to accumulate $2.5 million in 30 years, the calculator helps you determine how much you should invest annually based on different return rates. It also allows you to visualize how your investments will likely perform over the years while helping you set achievable targets.

2. It allows you to plan for tax implications

Your investment returns are subject to federal and state taxes, which can significantly impact your earnings. The calculator takes into account your tax brackets and estimates your after-tax returns. This allows you to understand the true growth of your investments. For example, if your investments generate a 10% return, but you are in the 37% federal tax bracket, your actual after-tax return is lower. Additionally, the calculator also helps you explore tax-efficient investment strategies. Based on the results of the investment calculator, you can select tax-efficient funds that help to reduce your taxable income.

3. It helps account for inflation

It is easy to focus only on the returns your investments generate, but your returns will be inconclusive without considering inflation. When using the calculator, you can enter an expected inflation rate and see how much your investment will actually be worth in the future. For example, if your investments are projected to grow at 8% annually, but inflation averages 3% per year, your real return is only 5%. The calculator takes into consideration inflation to help you see how rising costs may affect your future savings. It shows whether your current savings plan is enough to sustain your desired lifestyle or if you need to adjust your target to keep up with the cost of living.

4. It provides clarity and helps you plan better

Using the calculator also provides clarity in investment planning. You can compare different investment options, such as stocks, bonds, etc., and see how they perform over time. Even though investment returns are never guaranteed, the calculator can give you a realistic estimate based on historical data and advanced algorithms. This helps you make better decisions about where to invest your money.

Important considerations when using the investment return calculator

1. Inflation and taxes can be unpredictable

One key limitation of the investment return calculator is that its projections are not fixed. The calculator uses assumed values for factors like inflation and tax rates. These are not fixed, and real-world changes can significantly impact your returns. Inflation, for example, can fluctuate due to unexpected economic events. The COVID-19 pandemic caused inflation to rise suddenly. A higher-than-expected inflation rate could reduce your future purchasing power more than you anticipated. Similarly, tax laws can change with new government policies. This can alter how much of your investment returns you actually get to keep. While the calculator provides you with a helpful estimate, it is essential to review and update your inputs regularly based on current economic conditions.

2. Estimates are not guaranteed returns

The investment return calculator offers projections based on the information you enter. It is important to understand that these are not guaranteed returns. Your returns can ultimately be influenced by many factors like economic conditions, interest rates, etc. The calculator takes into account the investment’s historical returns. There is no certainty that the investment will continue to perform in the same manner in the future. For example, if the calculator estimates that a stock portfolio of large U.S. stocks will grow by 10.3% annually, that does not mean you will earn exactly 10.3% every year. In some years, you may earn more, say 13%, while at other times, you may even incur losses. It is important to use the calculator as a mere indication of what your investments can earn.

You can speak with a financial advisor to interpret the results more accurately and adjust your investment approach to align with your long-term goals.

To conclude

Wiser Advisor’s Investment Return Calculator can be a useful tool for financial planning. It is free, easy to use, and powered by an advanced algorithm that provides quick and accurate estimates. While the calculator offers helpful projections, it is important to remember that these are not guarantees. Market conditions, inflation, and tax rates can change over time and impact your actual returns. That said, the investment return calculator does give you a clearer understanding of how various factors, such as taxes and inflation, can influence your investment growth. It allows you to make informed financial decisions, but consulting a financial advisor can be a wise choice for personalized advice suited to your specific financial situation.

Use the free advisor match tool to get matched with seasoned financial advisors who can help create a personalized financial plan based on your specific needs and goals. Answer some simple questions about your financial needs and get matched with 2 to 3 advisors who can best fulfill your financial requirements.

Get matched to 1 to 3 advisors near you by clicking your state below:

Other posts from Paladin Editorial

Growth Investing vs Value Investing: Which is Better?

Among the many investment strategies available, growth investing and value investing are two popular ones. You have likely...

How to Check a Financial Advisor’s Credentials

A wealth manager or financial advisor’s credentials are not just names and terms thrown around. They signify a...

10 Investment Options for High Net-Worth-Individuals

Wealth changes the way you make financial decisions. Not because money suddenly becomes simple, but because the stakes...