When most investors think about investing in real estate, residential real estate is the natural thought that comes to mind first. On the other hand, commercial real estate which includes the ownership or partial ownership of the office properties people work in, the retail properties people shop in, industrial buildings where products are manufactured and the hotels people stay in when they travel, has become a more common investment in investors’ portfolios.

Many investors invest in commercial real estate to help:

- Diversify a portfolio

- Generate potential total returns

- Hedge against inflation

What is a Real Estate Investment Trust (REIT)?

Only a couple of decades ago, the ability to invest in commercial real estate was restricted to a few very wealthy individuals, pension funds, endowments, and the like. Securitization has allowed investors to pool their capital together to invest in commercial properties either through traded or nontraded opportunities via Real Estate Investment Trusts (REITs). Traded commercial real estate investment vehicles include entities that are traded on a national exchange. For example, a publicly-traded company whose main business is owning and operating a portfolio of office properties.

Non-traded real estate, often referred to as direct participation programs, are considered a direct real estate investment or an investment in the private real estate markets. The goal is to attain an investment with commercial real estate characteristics as opposed to an asset with financial market characteristics.

What Are the Six Major Property Types of Commercial Real Estate?

Here is a list of the asset class broken into six major property types along with some examples:

- Industrial: industrial parks, manufacturing buildings, distribution facilities, and research/development parks.

- Lodging: hotels, resorts, and extended-stay facilities.

- Multifamily: high-rise apartments, garden-style apartments, and duplexes.

- Office: high-rise and low-rise properties.

- Retail: freestanding stores and grocery-anchored shopping centers.

- Other: unique property types, including data storage, health care, and self-storage.

How are Real Estate Investment Trusts Performing in 2019?

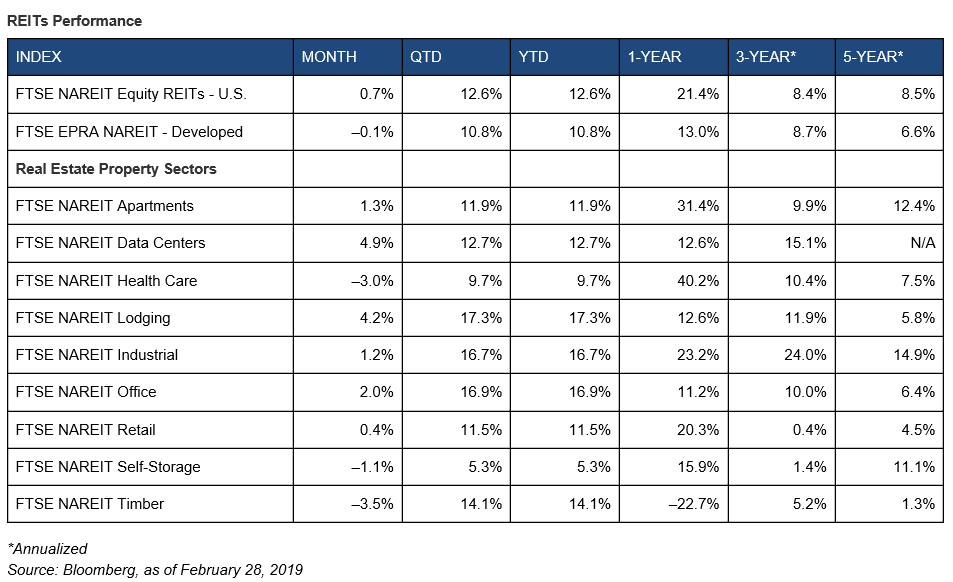

From a short-term perspective, the Bloomberg U.S. REIT Index tracks 166 equity REITs, of which 151 have reported thus far (as of my writing on 3/14). To date, the space has reported year-over-year quarterly sales growth of 5.1 percent and year-over-year quarterly earnings growth of 5.5 percent. Industrial REITs have led the way, recording sales growth of 14.2 percent and earnings growth of 31.6 percent. Retail REITs have underperformed, recording a sales decline of 1.4 percent and an earnings decline of 2.1 percent. You can see longer-term returns in the chart below with Industrial properties leading in the three and five year time frames.

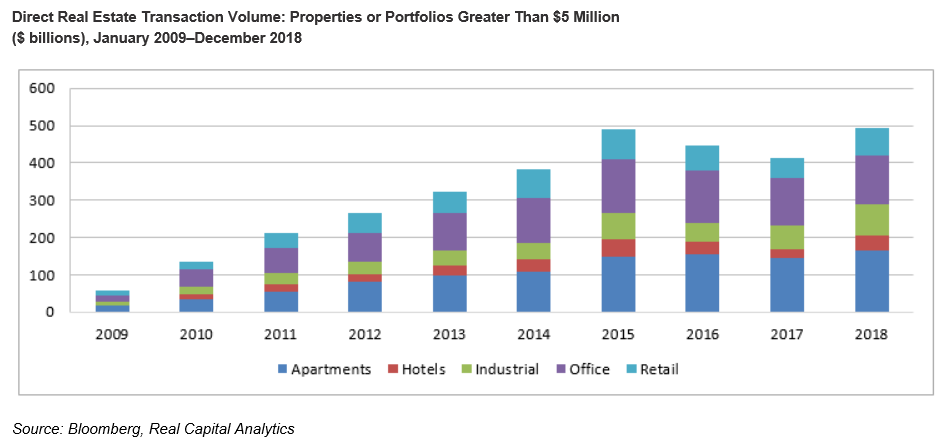

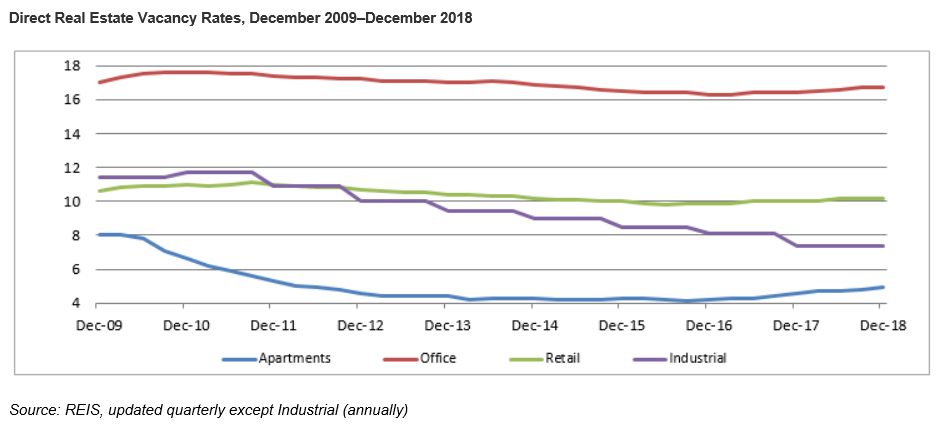

Again, from a shorter-term perspective, two important direct real estate data points were released in February: national vacancy rates and transaction volumes. REIS, the leading commercial real estate date source in the nation, recently reported fourth-quarter 2018 national vacancy rates. We are continuing to see a year-over-year increase in vacancy rates from most property types; apartment vacancy rates increased from 4.6 percent to 4.9 percent, office vacancy rates increased from 16.4 percent to 16.7 percent, and retail vacancy rates increased from 10 percent to 10.2 percent. Industrial vacancy rates are the only property type that bucked the trend, with year-over-year vacancy rates remaining flat at 7.4 percent.

As you can see, investing in real estate can offer benefits and should be considered based on your risk tolerance, goals and liquidity needs. Find a financial advisor who can help you determine if real estate investing makes sense for your specific situation.

Real estate investments are subject to a high degree of risk because of general economic or local market conditions; changes in supply or demand; competing properties in an area; changes in interest rates; and changes in tax, real estate, environmental, or zoning laws and regulations. REIT units/shares fluctuate in value and may be redeemed for more or less than the original amount invested. There is no assurance that the investment objective will be attained.”

A nontraded real estate investment trust (REIT) is a REIT that is not traded on any public stock exchange. Nontraded REITs are generally illiquid securities for which no public market exists. As such, investors may be unable to liquidate the security at any price. You should consult with your financial advisor and carefully consider your short-term and long-term liquidity needs.

FTSE EPRA/NAREIT Global:This index reflects trends in real estate equities worldwide. Relevant real estate activities are defined as the ownership, disposure, and development of income-producing real estate.

Co-authored by Gary Williams, CFP®, CRPC®, AIF® and Nicholas Ibello, CFP®, AIF®.

Gary Williams, CFP®, CRPC®, AIF® and Nicholas Ibello, CFP®, AIF® are Wealth Managers with Williams Asset Management. Williams Asset Management is located at 8850 Columbia 100 Parkway, Suite 204, Columbia, MD 21045. They offer advisory services as Investment Adviser Representatives of Commonwealth Financial Network®, a Registered Investment Adviser. Fixed insurance products and services offered by Williams Asset Management. For additional information about the services of Williams Asset Management, please call (410) 740-0220 or email at Info@WilliamsAsset.com. © Williams Asset Management. For more information about Williams Asset Management, please visit http://www.williamsassetmanagement.com/.

Other posts from Gary Williams

How Will the SECURE Act Affect My Retirement Plans?

In an effort to help Americans better save and prepare for retirement, Congress has passed the first pivotal...

The Risks and Rewards of Investing in IPOs

Have you ever heard someone touting how they got in on the “ground floor” of a publicly-traded stock...

What Does Retirement Really Mean (To You)?

Retirement is a nebulous word that means different things to different people. For some, it means leaving the...